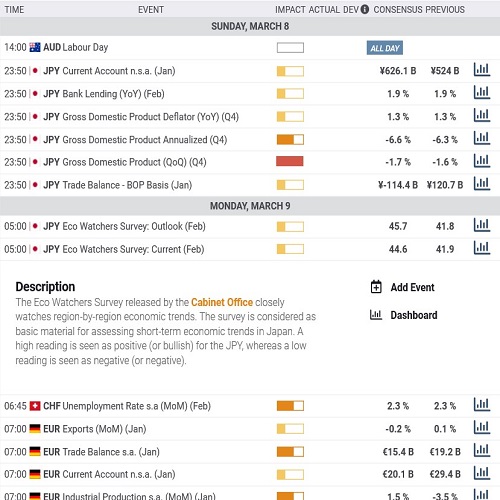

Following the economic calendar is an important part of fundamental analysis and can be extremely profitable for a forex trader. Knowing when important economic data is to be released gives the forex trader an advantage.

Following the economic calendar is an important part of fundamental analysis and can be extremely profitable for a forex trader. Knowing when important economic data is to be released gives the forex trader an advantage.

The Purchasing Managers’ Index or PMI is an important leading indicator used in fundamental analysis. The PMI comes out on the first business day of the month after the data is compiled and is used as an official component of the U.S. Conference Board’s Leading Index.

There are essentially two types of fundamental analysis which long term investors should familiarize themselves with in order to pick the right stocks for their portfolios - intrinsic and extrinsic.

An economic calendar is a very useful tool in fx analysis to register profits as the markets react to current events and government announcements. A recent example is how the United States Dollar soars on strong jobs reports that top the expectations of the Wall Street community.

Research is an essential ingredient in CFD trading. The most popular research method for technical analysts is chart analysis.