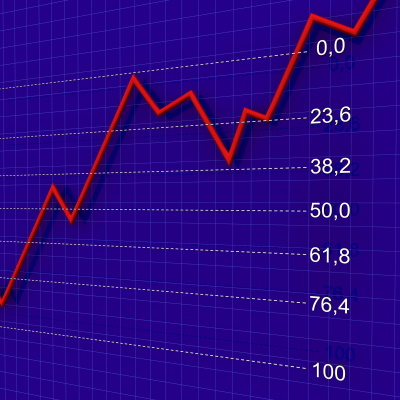

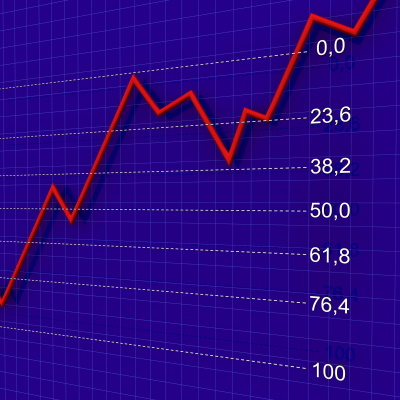

Fibonacci numbers are used by stock traders to evaluate support and resistance price levels. Read on to find out more with Queensway.

Fibonacci numbers are used by stock traders to evaluate support and resistance price levels. Read on to find out more with Queensway.

Range trading can be profitable when utilising indicators and charts to establish the Forex pivot points for buying and selling currencies.

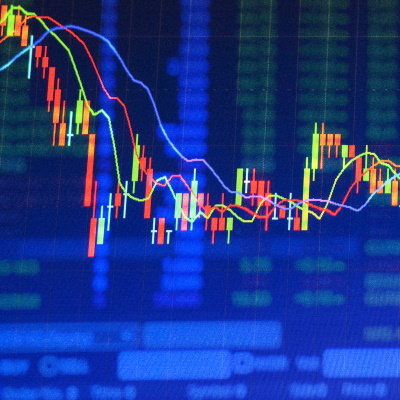

Among the most popular indicators for technical analysts, moving averages are one of the most widely used. Learn how to use moving averages with Queensway.

Swing trading is a trading strategy in which trades are entered to take advantage of the retracements that occur between the support and resistance levels that lie along major trend lines.

The Fibonacci Theory can yield forex trading profits from a forex strategy based on the commonality of numbers.

Read about how you can combine crossovers in the MACD and Stochastics indicators to obtain more accurate forex trading signals.

Read about how to compute the MACD indicator developed by Gerald Appel that is popular among technical analysts for generating trading signals.

Technical analysis is all about calculating future price action of a stock based on its past and, unlike fundamental analysis, not about the intrinsic value of the stock.