The Basics of Trading Psychology

Trading psychology is about reading market sentiment while controlling your emotions. Read on to discover the basics with QueenswayTrading psychology is about reading market sentiment while controlling your emotions. Read on to discover the basics with Queensway

Trading Psychology 101 – How to read market sentiment and master your emotions to trade smarter

Psychology, the science of human personality, thought, emotion and behaviour, can help us improve our relationships and careers and enhance enjoyment of our interests and passions.

Thinking about how our own minds work enables us to understand the way motivations influence our perception of situations and guide our decisions. It also helps us understand the desires and actions of others, whether we wish to help them or gain an advantage over them.

The traditional approach in business was once to follow ‘gut instinct’ when making key decisions, but over the past few decades, this has given way to a far more data-driven methodology.

Strategic decisions by C-suite executives must now be backed up by cold, hard numbers that prove existing trends and indicate realistic projections.

Every decision must be subjected to cost-benefit analysis to evaluate the risk presented and the potential reward offered. This inevitably puts pressure on people at every level of an organization, and some are simply unable to handle it.

Stress creates negative emotions which cloud their judgement and can lead to disastrous decisions. We read about the fallout from these decisions whenever a major company folds or a new product fails.

Online trading psychology – a microcosm of the corporate world

These principles are especially relevant to investing, which can be a roller coaster ride of emotions. Even the most experienced traders enjoy the exhilaration of closing a successful position and dread the disappointment of making a wrong call.

Independent traders, just like the professionals employed on Wall Street and in the City of London, can sometimes lose sight of the bigger picture or even burn out completely.

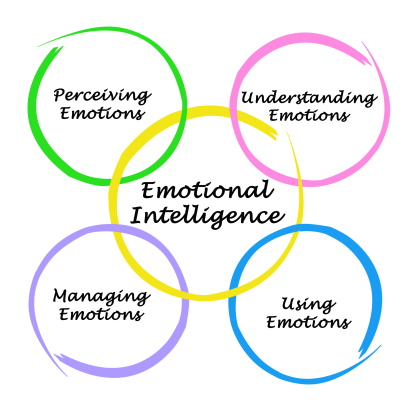

Understanding trading psychology is one of the keys to long-term success. Mastering your emotions enables you to drill down into the data, think fast and make better decisions on new trading positions. This is what behavioural finance is all about – studying the way traders react to certain situations in order to understand how and why they make their decisions.

In particularly volatile areas of finance, especially the stock market, professional psychologists often help to train traders, enabling them to understand themselves better and to get to grips with the dynamics of stock market sentiment. Traders specializing in other asset classes can also benefit from many of the same lessons.

Their insights also prove invaluable to independent traders. Whichever markets you’re focusing on, using behavioural finance can help to identify better ways to approach them. Understanding both yourself and market dynamics more fully will greatly improve your overall performance.

The essentials of trading psychology

Psychology related to trading mainly relates to both market dynamics and buyer sentiment.

- Market dynamics are the result of certain conditions created by previous events, company reports, economic data releases and geopolitical tensions, for example. In other words, it tells us what the overall mood of the market is and what sentiment — bullish, bearish or neutral — is prevailing.

- Buyer sentiment refers to the psychology of an individual investor, often informed by their past experiences in trading and what they expect will happen soon. It is often used in a negative context, since an effective trader will act calmly and rationally, rather than basing their decisions on emotions.

The real challenge of trading lies in overcoming the hardwired emotions triggered by success and failure while judging whether the market as a whole is behaving logically or if the majority of other traders are acting irrationally, often by following the herd.

Novice traders are naturally more prone to emotional trading and are often more susceptible to stress. They frequently question the wisdom of their decisions, which makes them close out strong positions too early. On the other hand, they might hold a losing position open too long, sometimes due simply to pride.

The two most toxic emotions you need to get rid of

A number of negative emotions can adversely affect your trading judgement, but the two most significant ones are fear and greed.

- Fear – at some point, every trader must conquer their fear of losing. Nobody enjoys it when a position doesn’t work out, but not even the world’s most famous investors get it right every time. Then there’s the fear that sets it after three or four failures: that this could be the start of a long losing run. This is also an irrational fear. The logical approach is to accept that trading always involves ups and downs and that the key to long-term success is to learn from your mistakes, to improve your technical and fundamental analysis skills.

- Greed – inexperienced traders sometimes get greedy, holding a position open too long in the hope of a bigger win, only to miss the right moment to close it and see their profits evaporate. This is often because they haven’t yet developed a trading plan incorporating rules for when to enter and exit a trade. If they do have a trading plan, they don’t stick to it. Either way, this is bad money management, which often leads to poor decisions and potentially large losses.

Practical trading psychology – taking control of your emotions

These straightforward tips will help you increase your self-awareness and set you on the path to becoming a better trader:

- Make a list of the emotions that influence you most in daily life

- Keep a log of every time you experience those emotions when trading

- Cross-reference your trading successes and failures with your emotion log

- Refine the entry and exit criteria in your trading plan to address your weaknesses

- Above all, stick to that plan

Using behavioural finance to master the markets

Once you’ve fully understood how emotions can influence your decision-making process, it will be easier for you to overcome them to become a more effective trader. Once you’ve achieved the right level of detachment and rationality, you’ll be able to read overall market dynamics more successfully, leveraging your insights to become a master investor.