How to range trade using pivot points

Range trading can be profitable when utilising indicators and charts to establish the Forex pivot points for buying and selling currencies.

Pivoting a Position

To trade profitably within ranges utilising pivot points, Forex indicators must be deployed within the established parameters. Range trading offers Forex traders pre-set limits within charts that can result in profitable buying and selling. Combining the two can offer excellent trading opportunities.

Forex Pivot Points Defined

Pivot points provide price levels that can be used to indicate support and resistance levels for a financial asset for any period desired. From these, traders can set up the trading range. This enforces risk management for the range trader, which is critical for all investing, not just foreign currency buying and selling.

As pivot points are derived from a preceding period’s high, low, and closing price, a trading range can be accurately set up and continually revised based on new market conditions from one period to the next.

The forex pivot point is very useful in the foreign exchange market due to its size. Distorting a market through manipulation would otherwise destroy the trading ranges, resulting in huge losses. The depth and breadth of the foreign exchange market, however, is a barrier to manipulation, which is critical for the range trader as parameters are set with Forex charts for buying and selling foreign currencies.

Range trading is very useful for those looking to profit from buying and selling foreign currencies, as it is a form of risk management. Establishing trading ranges for a foreign currency that is derived from Forex indicators and charts will prevent large losses, if followed.

Support and Resistance Levels

A key tool in the trading market and used to answer the question of how to calculate pivot points and support and resistance levels which fall below and above the stock pivot point.

This is done by either adding or subtracting from the price differentials which are established by using the data gathered from the previous trading years.

Now, it goes without saying that this is by no means an exact number, but merely an educated calculation in order to provide a predicted movement pattern to help investors make more informed decisions on suspected growth of that particular market.

These are assumptions and are based on projected trends from previous trading years and also take into account whether the market is in decline or incline.

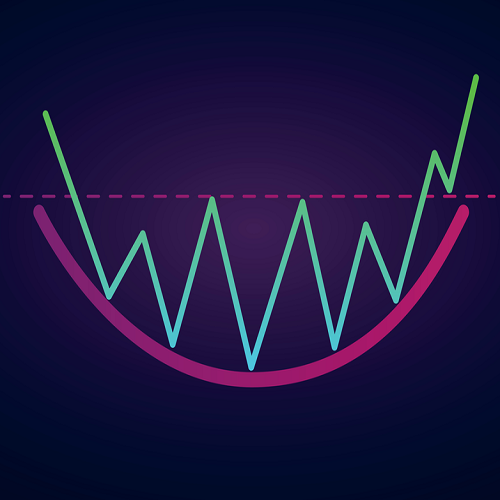

There are usually 3 levels that will be indicated above and below the pivot point in a pivot point analysis which is shown in the graph below.

Stock Pivot Point Chart Example

Below is a pivot point chart indicating a period of 8 months.

In this chart, there are only 2 levels of resistance and support indicated. The green lines which are labelled R1 and R2 show the first and second levels of resistance in correlation to the pivot point.

These pivot points are indicated by the yellow lines and are merely predictions based on prior trading periods.

The red lines which are labelled S1 and S2 are the markers used to indicate the support levels predicted.

The support levels are set based on the current trend of the market and are derived from previous periods. These are basically predicted turning points in terms of the direction in which the market is going.

The support level represents a stable price on the low side which is usually an invaluable tool when the market is in turmoil.

Resistance levels are set to indicate an imaginary ceiling in terms of how much the market is intended to grow.

Keep in mind that these are also based on prior trading periods and are in no way an exact indication of market growth. Resistance levels are merely used as a gauge for up-trending markets and give investors an idea as to when the growth is no longer sustainable or where the price should be considered as the highest it can go with a sense of certainty.

When investors begin trading in their chosen market, it is essential that they consult as many pivot points charts as possible.

A Rule of Thumb when Entering a Market

There is usually no real way to know when you should begin investing in a market; however, there is a trend that has been discovered over the years.

If investors enter the market when trading is below the stock pivot point, the market sentiment will almost always follow in this direction. This is a good indicator that the prices are more than likely going to drop, whereas, should investors enter above the pivot point, the opposite is what usually happens.

The market is highly dependent on sentiment and goes hand in hand with what investors do. Pay close attention to the charts, make sure you analyse short-term and long-term charts which span from minutes to years. By doing this you will give yourself a much higher chance of predicting the current direction in which the market will go.