The History of the Stock Exchange

From their humble beginnings in the coffee houses of London, stock exchanges have transitioned from physical centres where stock is exchanged, to the super computers and the electronic exchange of stocks and shares.

Exchanging Shares

When people talk about the stock exchange, they are actually talking about thousands of companies which have put a part of themselves up for investment and the stock exchange is a physical place where those shares of a company can be purchased and sold. Shareholders who invest, through buying shares, own part of the company, help the companies they invest in fund themselves with the necessary money needed to operate, expand and enter into ventures that will make them profitable. In return, most companies (by no means all – in fact some very high-valued share issuers don’t!) share their profits with stockholders in the form of dividends.

The stock exchanges started when the money lenders in Europe began to fill the gaps that the banks were leaving. They traded debt amongst themselves (dispersed stock exchange), mostly high-interest loans for securities. In 1300, the Venetians started trading securities issued by other governments. They scribbled information about sales issues on slates and carried them whenever they met with clients.

Considered the first, the Antwerp stock exchange was established in 1531. To begin with, they only dealt with promissory notes and bonds. In the 1600s, British, Dutch and French companies trading received government mandates to trade in the East Indies. However, these voyages were dangerous and profits not entirely secure.

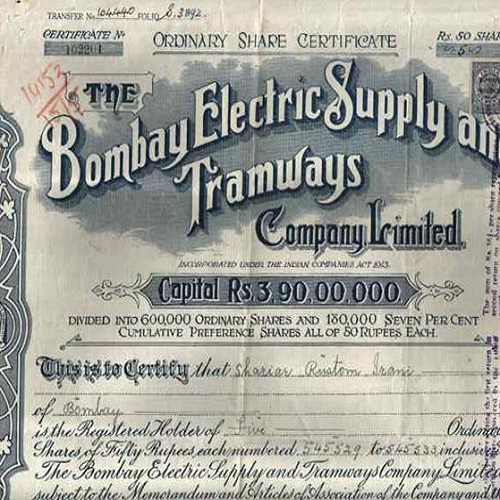

Pirates and poor weather were the risks factors that needed to be avoided. Ship owners thus offered a share in the profits to people willing to invest in the venture – in some cases such shares only applying to a single voyage.

The result was an early form of limited liability companies whose shares were registered on paper that could be transferred to anyone prepared to take on the risk. Such transfers were overseen by stockbrokers who had to be physically present with their clients to carry out successful trades. In London, such stockbrokers kept office in the city’s coffee shops.

Rules, regulations and ‘rithmetic

The result of all this was a financial boom in the years that followed – especially during the 18th century – merchants investing their gains in new initiatives and businesses. As always happens, soon, the speculators became prominent and risks were taken beyond what the market should have been expected to endure. Thus, for example, in the toward the turn of the century, a group of East India partners who had been cast out of the company shorted their stock causing the eventual destruction of that company and its monopoly. The result – the first case of market regulation, wherein short-selling was forbidden.

And so, stock exchanges began to develop in the manner to which we are now accustomed (or at least the way in which we were accustomed until the proliferation of online trading in the past decade) – London’s in 1773, Philadelphia in 1790 and New York in 1792. The first electronic exchange was that of the National Association of Securities Dealers Automated Quotations (NASDAQ) in 1971 – one that entailed no physical place to meet and exchange stock.

Another interesting development of the time was the stock index. Contrary to those who may claim that the American Henry Varnum Poor created this with his first railroads listing in 1849, it was in fact John Castaing who in 1698 began posting the prices of stocks and commodities on the walls of the London Jonathan’s Coffee House owned by Jonathan Mills.

Today’s benchmark for understanding how the US stock exchanges are performing is the Dow Jones Industrial Average, formed in 1885 by Charles Dow and Edward Jones who were editors of the Wall Street Journal. The Dow is an index of 30 high capitalisation American public companies and generally, if the Dow goes up investors are optimistic; if it goes down they are pessimistic.