Strategies not Optional

The best way to understand options strategies is to experiment on a demo account until the computations are ideologically internalised. Here are a few.

Some Popular Options Strategies

Because of the double-edged nature of options, it is difficult to visualise their evolution along a 2-dimensional chart, since at expiry, all possibilities must be envisioned – calling for a sort of 3rd-dimensional time slice along the axis – an independent profit/loss chart that delineates potential outcomes. Thus, the best way to understand options strategies is to experiment on a demo account until the computations are ideologically internalised. Additionally, sites such as optioncreator.com provide online analysis as strategies are created.

The Covered Call

As its name implies, this is a strategy to simply cover a buy order on an asset by selling an opposing option. It is used if the asset’s direction is unclear, generating income on the premium alone. If the asset rises surprisingly, its profit covers the loss on the sold option as it is exercised by the option buyer.

The Married Put

The Married Put is in effect the opposite of the Covered Call, used to protect against a depreciating asset. The trader executes a sell order on the asset and buys a put option on it. The loss on the depreciating asset is covered by the profit from the put option. If the asset appreciates, the trader does not exercise the option, foregoing the premium.

The Bull Call Spread

A call option on an asset is bought and another sold at a higher strike price than the first but with the same expiry date. The profit on the bought option is capped at the strike price differential, but the premium is reduced. If the asset depreciates, both calls expire out of the money and remain unexercised.

The Bear Put Spread

Once again, the reverse of the bear call spread is used in a bearish market. Put options are bought and sold, the latter at a lower strike price. The profit on the bought option is capped at the strike price differential, but the premium is reduced. If the asset appreciates, both puts expire out of the money and remain unexercised.

The Long Straddle

all and put options are simultaneously bought with the same expiry and strike prices. The strategy is primarily used in volatile markets, where significant movements are expected, but the direction remains a mystery. Losses are capped slightly beyond the two premiums, but profit is theoretically unlimited. The out-of-the money option is disregarded, its premium lost, but the option that’s in the money is exercised.

The Long Strangle

The long strangle is similar to the long straddle but premiums are reduced, since the options bought are both out of the money at opening.

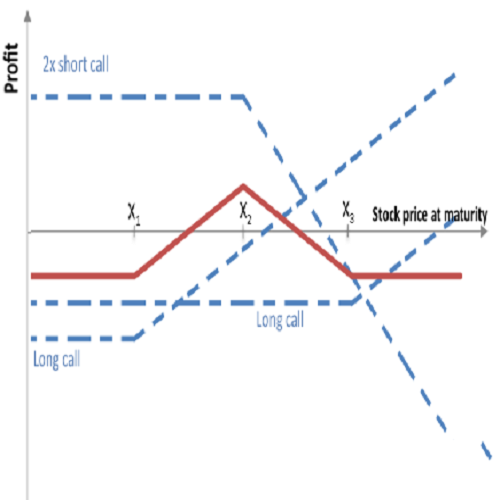

Complex Strategies

Some strategies call for the use of both in and out of the money options. The Long Call Butterfly Spread, for example, involves buying an in-the-money call option and selling 2 at higher strike prices. Both profit and loss are capped. The Iron Butterfly involves selling an in-the-money put, buying an out of the money put, selling an in the money call and buying an out of the money call. Finally, the Iron Corridor strategy actually involves two simpler strategies – a bull put spread and a bear call spread. Profit is based on the premiums received.