OTC trading vs Exchange trading - What’s best for you?

Among the most popular indicators for technical analysts, moving averages are one of the most widely used. Learn how to use moving averages with Queensway.

Over the Counter – Into the Pan

No matter how a securities transaction is cleared and settled, there are always opportunities for traders to make money on the financial markets. This is true whether it’s a highly regulated exchange trading transaction or an over-the-counter (OTC trading) deal made by a retail trader accessing the global markets directly from their PC.

Of course, the price determination process, market stability and counterparty risk differ significantly between trading OTC stocks and buying them through an exchange.

This is also the case when it comes to foreign exchange trading (Forex), since currency exchange trading is all about taking advantage of price changes in exchange rates on unregulated markets.

Depending on the individual trader’s strategy and tactics, along with their trading style and the financial instruments being bought and sold, there are significant differences between OTC trading, which is transacted between two parties, and exchange trading, which is overseen by official governing bodies.

Trading on an exchange vs. Trading over-the-counter

Exchanges were once limited to physical locations such as the New York Stock Exchange (NYSE) where deals were made in “pits” by traders in brightly coloured striped jackets. With exchange trading, all positions and transactions must be completed through an official, central organisation.

This system connects buyers and sellers and ensures the security and integrity of the transactions. All financial products traded through exchanges are therefore standardised and follow an extensive list of strict rules.

Over-the-counter trading, on the other hand, was never confined to a dedicated trading floor. It usually involves decentralised markets where there is no single mediator making the link between buyers and sellers, but multiple ones.

Market participants, therefore, trade assets directly between themselves (without the need to go through a central exchange). OTC transactions are conducted electronically, which is more convenient (and usually cheaper) for investors.

As the trading counter-party of an OTC transaction isn’t an exchange, the prices of OTC products aren’t regulated by a governing body.

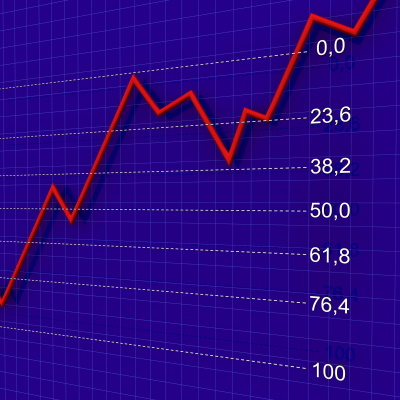

Instead, they follow market dynamics and the basic principle of demand and supply, which can often influence the level of market liquidity – essentially the number of people trading a given asset at any one time – which determines whether a desired trade can be made at a certain time.

CFDs and OTC trading

A CFD, or Contract for Difference, represents a contract between two parties to exchange the difference in value between the opening price of an asset and its closing price.

As a CFD is an agreement concerning only the price difference between the entry and exit level of a trading position, investors do not need to own the underlying asset, making this a simple and streamlined form of trading that is the first choice of tens of millions of people around the world.

CFDs are leveraged derivative products, which means that traders need to put aside only a small part of the total value of their positions to open one. This amount is called the margin, and the rest of the value of the position is loaned to the trader by their CFD broker.

Trading on margin means a trader can get greater market exposure with a relatively small initial capital investment (depending on the leverage applied). It also means that every price movement will magnify profits or losses.

Another appealing aspect of using CFDs to trade stocks on OTC markets (or any other market, for that matter) is that traders can profit from rising prices by going long (buying) or from falling markets by going short (selling).

What instruments can you trade with CFDs?

In addition to stock trading, CFDs can be traded on a wide range of other asset classes:

- Indices

- Forex & Cryptocurrencies

- Debt & Bonds

- ETFs

- Commodities

- Shares

Why take advantage of trading CFDs online?

Trading products on the OTC market gives traders greater flexibility compared to their more regulated exchange-based counterparts. Moreover, with no transfers of ownership, there is greater potential to rapidly take advantage of both bullish and bearish market conditions on many different assets.

With low transaction costs, online CFD trading has quickly become hugely popular and is open to anyone with an internet connection in most locations.

While forbidden in the United States due to restrictions by the Securities and Exchange Commission on over-the-counter financial instruments, CFDs are very common in other parts of the world, including the following countries:

- The United Kingdom

- Hong Kong

- The Netherlands

- Poland

- Portugal

- Romania

- Germany

- Switzerland

- Italy

- Singapore

- South Africa

- Canada

- New Zealand

- Sweden

- Norway

- France

- Ireland

- Japan

- Spain

Forex: the most popular OTC market

Instead of using exchanges, FX traders are more likely to use a decentralised network of banks or other dealers to buy and sell currencies.

As their trading isn’t linked to any exchange, it doesn’t have to be tied to opening and closing times. Therefore, currency exchange trading can be carried out 24 hours a day.

The FX market is the largest and most liquid market in the world with more than $5 trillion exchanged every day. This constantly attracts more traders, keen to test their insights and intuition and increase their capital.

Advantages of Foreign exchange trading

- Open 24h/day, 5 days a week

- Low barrier to entry

- High liquidity

- Low trading fees

- Small initial capital required

- High leverage on popular pairs

- High volatility

- Wide options of currency pairs to trade

- Ability to benefit from falling as well as rising price movements

- No fixed lot size

- Different trading styles can be used

Choosing a broker

Once you’ve set out your financial goals and decided on the trading style that suits you, you’ll need to choose a broker that can offer you the best set of trading conditions, access to generous leverage and a wide choice of tradable assets. This is one of the most important choices you’ll make as you set out to become a successful online trader.