Identifying Engulfing Bars

The engulfing bar is the easiest of all the forex chart patterns to identify; and, as such, if all engulfing bar characteristics are met, the trade will be successful, whether it is a reversal pattern or a continuation pattern.

Dismay, Engulf & Devour

The engulfing bar is one of forex Traders favorite candlestick patterns because it gives a reliable signal and it is very easy to identify. This is a key feature for successful forex trading. As it only needs two candlesticks to form what is called the engulfing bars pattern, it is the most easily identifiable patterns of forex chart patterns.

Engulfing within

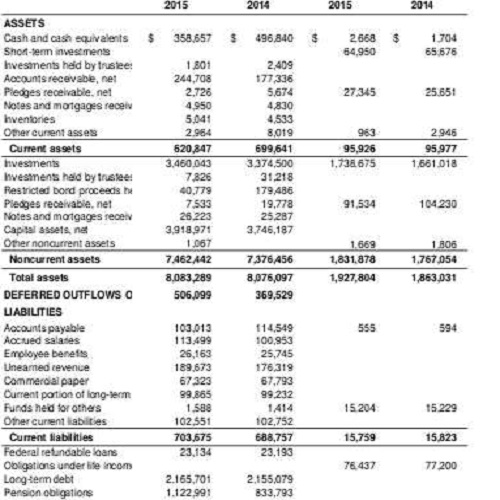

The engulfing bar is a reversal pattern or signal and is formed when the latest candle completely engulfs the candle to its left. If it engulfs more than one candle, it indicates a very strong signal and is much more reliable as a reversal signal. On occasion, an engulfing bar which engulfs or partly engulfs a single candle can indicate a continuation signal. The chart below shows some examples of engulfing bars.

There are four examples of an engulfing bar on the chart. Example 1 is a continuation engulfing bar pattern. Example 2 is a bearish engulfing bar pattern. Example 3 is also a bearish engulfing bar pattern. Example 4 is a bullish engulfing bar pattern.

Notice also that these patterns tend to occur where there are support and resistance areas. These areas on the chart are indicated by the two arrowed horizontal lines.

As you might have guessed, when a bar devours the previous bar it shows that the market has made up its mind which way it is going. If the previous bar is engulfed by a bullish bar the market will become bullish and the trader should take a long position. If the previous bar is engulfed by a bearish bar the market will become bearish and the Trader should take a short position.

The characteristics of engulfing bars are that they must fully engulf the previous bar – at least the body, but preferably the high and low as well, as the bigger the bar the stronger the signal. They must be in either a support or a resistance zone.

On being picky

The engulfing bar is traded only when it meets the characteristics of a true engulfing bar pattern. It would be unwise to trade it if only half the characteristic criteria were met because your chances of a good profitable trade would be severely diminished. Once you are satisfied that you have a true engulfing bar, you can start to strategize on how to trade it.

Firstly, work out what the current market is doing: is it ranging; is it in a bull trend or a bear trend? Then you need to ensure that the engulfing bar is in a support or resistance area. It is essential to the success of the trade that the engulfing bar is in that sort of area. To trade the engulfing bar, place your entry order for a price that is just above the high for a bullish bar and just below the low for a bearish bar. The stop losses should be placed right on the high for a bearish bar and right on the low for a bullish bar. The partial chart below shows where the entry and stop should be placed.

A Trader making this particular trade would make some 150 pips profit.