How to Profit from CFDs

This article will talk you through what CFDs are, their advantages and disadvantages and how those disadvantages and advantages can benefit you in the future.

What are CFDs?

Contracts for Difference, or CFDs, are contracts that say that the holder will pay or receive the difference between the price of an asset at the open and close of the contract. This means that Traders can make the same profits as if they were actually buying or selling but without ever owning the assets. This type of financial instrument is called a derivative product. These have no inherent worth but are used to represent the value of some other asset that they gain value from.

Advantages

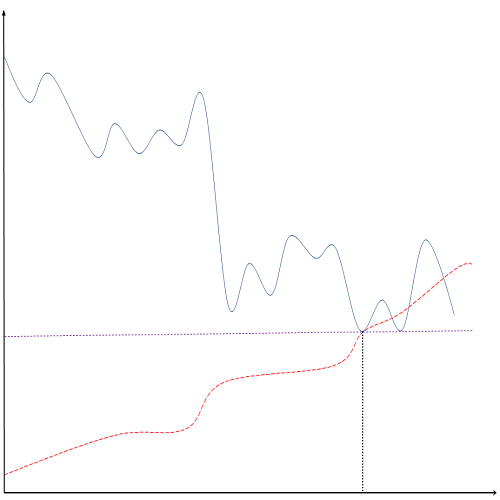

There are a number of advantages to trading CFDs as opposed to the assets themselves, mostly as a result of greater flexibility. For example, when you are trading CFDs online, you are not limited to the lot sizes dictated by the market. Because the trades are not actually being executed in the market, they can also be faster, with higher liquidity. CFD trading also widens the range of assets that you can trade on margin, using leverage. Using leverage can make a huge difference to your CFD trading strategy since it means that you can make large profits with small amounts of capital invested in each trade.

Disadvantages

Of course, some of the strongest reasons to trade CFDs are also reasons to be cautious when creating your CFD trading strategy. Whenever you use leverage you increase your risk as well as your potential profit. Because CFDs are private contracts and are never actually executed in the market, it’s also particularly important to make sure that you trust your CFD broker. They should be regulated and information about their terms and conditions of trading should be easily accessible. However, the largest risks associated with trading CFDs are the same ones that exist with any trade. If you incorrectly predict changes in price, you will lose money. That’s why it’s important to take precautions to minimize your risk and maximize your profit.

How to Profit

The most important factor in profiting when trading CFDs is the same as with any other trading: preparation. As with other short-term trading, it’s important to know how to use technical analysis and to have at least a basic understanding of fundamental analysis. This will help you decide when to enter and exit each trade. The more you know what influences prices in the market and sector you’re trading, the better you’ll be able to predict movement. Preparation is also the key to minimizing risk. Having a clear plan will help you to react correctly if a trade is going against you.