Trading With Forex Signals

Queensway uncovers how traders skilled in technical analysis use objective Forex signals to fine-tune their entry or exit strategies.

Trading With Forex Signals

Simply defined, Forex signals are suggestions that traders use to make a decision to execute a deal in a particular currency pair.

In addition to the currencies traded, such signals also typically specify a timeframe, exchange rate, direction, as well as stop-loss and take-profit levels for the suggested trade execution, these based on pivots, Fibonacci, Gann and other technical indicators.

Many technical-minded currency traders generally prefer the objectivity that Forex signals can provide. Herein, we present some advantages of using trading signals and examples from the past.

Trading With FX Signals Helps Eliminate Emotional Trading Errors

Forex trading should just involve the analysis of numbers and charts when objectively deciding when to enter and exit the market. However, mistakes caused by emotions and psychology often influence traders’ logical decisions.

Many novice currency traders witness their portfolios fall victim to various common errors that can occur as a result of their natural emotional responses to making and losing money. Psychology biases are therefore one of the biggest obstacles to currency trading success.

Technical analysis or a professional signal service that generates Forex trading signals and directs exactly when to enter or exit positions can truly help traders eliminate potentially problematic emotional responses.

Once a successful signal generation system has been established and tested, traders simply need to develop the discipline to trade whenever that system gives them a signal.

Signal Trading Systems can often be Back-Tested

Another advantage of trading with FX signals is that a particular trading strategy can usually be backtested over historical data to determine how successful it would have been if used over that time period.

Although the past is not always a good predictor of the future, this testing method allows technical traders to choose between different trading systems based on what would have been most profitable.

Backtesting can also allow traders to optimise the profitability of their signal generating systems based on an acceptable maximum drawdown level. They can also select a system that is as close as possible to a system with minimal drawdowns and consistent profitability over time.

Signal Trading System Examples

Although most FX signal generating services are black boxes due to their proprietary nature, traders can use various well-known technical analysis techniques to generate their own trading signals.

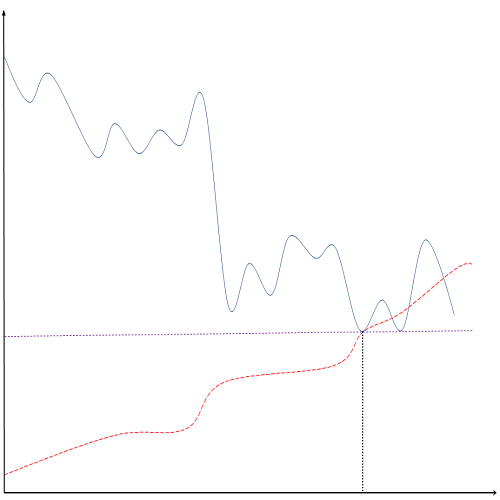

For example, crossovers between short-term and longer-term moving average: when the short MA moves above the long MA, it usually signals a buy, and when the short MA moves under the long one, it is usually time to sell.

Another classic signal is generated by the RSI (Relative Strength Index): When the RSI is in extreme territory — which is considered overbought above 70 and oversold below 30 — then wait for the exchange rate to make a new extreme level without the RSI doing the same. This sort of divergence reliably signals that a counter-trend position can be taken in that currency pair.

How to Create the Perfect System to Get Reliable Forex Trading Signals

It doesn’t take long to design a trading system, but you need to take some time to extensively test and backtest it and make the necessary adjustments. It is, therefore, best to be patient in finding a trading system that can generate reliable signals.

Determine your trader profile

First, you need to think about your personality and your trader profile. What kind Forex trader are you? What trading style suits you best? Day trading or swing trading? This will help you determine the best type of time frame to rely on.

Find out the main trend and the stage within this trend

You need to remember that ‘the trend is your friend’. It’s always better to ride a trend than to go against it. So, first, look for indicators that are trend-following and help you determine when a trend is about to change. Then, select different indicators that will help you confirm the trend to strengthen the reliability of your buying or selling signals.

Use relevant indicators to spot new trends

We previously talked about moving average crossovers – these are one of the fastest methods to use when wanting to spot new trends and trigger trading signals. The RSI can be used to avoid false signals and highlight a signal for a new trend.

That is why combinations of signals generated by several different technical indicators should be used to provide more selective trading signal results. This can give you a better chance of yielding a successful trade.

Define the risk you’re willing to bear – set up money and risk management rules

When developing your trading signal strategy, it is essential to determine your relationship to risk. Are you risk-averse? Are you willing to take risks to potentially get wider gains? What are your trading goals? Think about how much you’re willing to lose on each trade and how much you hope to gain. This will help you determine your risk/reward ratio, the size of your positions, and the leverage to use when trading.

Write down your strategy in your trading plan and follow it

Your trading plan should always be in writing so you can follow and refer to it when needed. Write down everything about your investment strategy: the market analysis approach adopted, entry and exit trading set-up to follow, position-sizing, risk to accept, technical indicators to use, and so on.

Patience, commitment, and discipline are the most important characteristics of a successful trader who follows their trading plan to get the best Forex signals.