CFD Online Trading - How to Become an Independent Investor

Want to succeed in CFD online trading but don’t know where to start? Read on to discover what CFDs are and how you can trade them.

Investing Independently

Contracts for Difference or CFDs have become extremely popular financial instruments, especially for short-term traders. They offer a way to benefit from fast-moving assets regardless of the direction of the markets and require a relatively small initial trading capital.

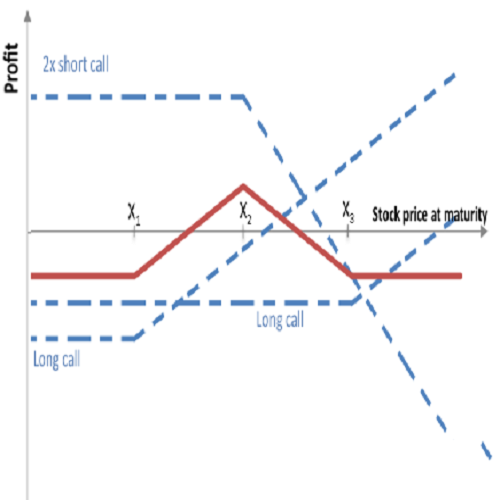

However, the most attractive feature is that the trader does not have to actually purchase the underlying asset. The thrust of this is that one can invest in an asset’s falling value, not only its increase – shorting the asset.

What are CFDs

First used in the early 1990s in London, their invention is credited to Jon Wood and Brian Keelan, who employed the instrument in the Jardine Matheson takeover of British real estate giant, Trafalgar House. This was executed as a liquidity swap. In such a transaction, two parties agree to use a CFD for a property valued at £1m.

Before the agreed execution date (the expiration of the contract), the value of the asset will either increase or decrease. If it rises to £1.2m, the seller must pay the buyer the difference of £200k, whereas if the value falls to £700k, the buyer must pay the seller the difference of £300k. Thus, no actual sale takes place and taxation is avoided.

It was in the financial markets, however, where CFDs made their biggest impact. With the rise of the internet, CFD online trading opened up the world of investing to retail traders, providing instant access to the following asset classes:

- Shares (Amazon, BNP Paribas, EasyJet, Volkswagen, etc.)

- Forex (EUR/USD, GBP/JPY, AUD/CAD, CHF/NZD, etc.)

- Indices (S&P 500, CAC40, FTSE100, DAX30, etc.)

- Commodities (Gold, Oil, Corn, etc.)

- And even ETFs

What is CFD trading?

A CFD is a financial agreement between two parties to exchange the difference in an asset’s value when opening a contract and closing it. The trader does not own the asset but simply predicts whether its price will move up or down.

CFDs are leveraged instruments that are traded on margin, enabling the trader to invest in a position that is much larger than he/she has in actual equity. The trader mortgages a small amount (the “margin”) while leverage is the ratio between the margin and the size of the trade one’s broker actually initiates.

The most popular assets like Gold and the EUR/USD currency pair will offer leverage of up to 400:1 for professional traders, while specific stocks may offer leverage of just 10 or 20.

Trading example

Let’s say that you think the stock price of a certain company, which now stands at $190, will rise. If the stock is priced at $190.10 (the bid price or selling price) / $190.15 (the ask price or buying price), you can use a traditional financial product and purchase 100 shares at $190.15 for a total value of $19,015.

Alternatively, you can use an online broker. This will enable you to take advantage of margin trading to reduce the amount of money you need to invest.

As the margin typically varies between 3% and 15%, depending on the liquidity of the underlying asset (how many people are currently trading it), in this example you would have to put up only between $570.45 (3% margin) and $2,852,25 (15% margin) to open your CFD position.

When you close the position, you will be selling the same asset at its bid price (lower than the updated ask price at all times – they rise and fall in tandem). This inherent disparity is referred to as the “spread”, and it replaces the commission the broker would otherwise take.

The broker will also charge for overnight financing if you hold your position longer than one trading day, which can affect your overall performance.

How did online trading become popular so quickly?

Online trading has developed into a global phenomenon. With no transfers of ownership, the ability to open long or short positions on hundreds of assets, plus low transaction costs and trading fees, the world of investing is now accessible to anyone with an internet connection.

How to wisely use leveraged financial products

While margin trading and leverage can seem daunting to new traders, there are a few easy rules to follow to better control risk when trading with CFDs. Here are the most important guidelines:

- Always set strict money management rules when working on your trading plan

- Closely monitor the markets you’re investing in

- Follow the news and the economic calendar to stay aware of events, speeches or data releases that can trigger high volatility (market swings)

- Control the size of your positions depending on market conditions

- Vary the level of leverage you’re using

- Know when to trade and when to stop

Is CFD online trading for you?

Before you begin trading, it’s also worth considering your trading profile and trading strategy – your personality and your plan – to make sure you know what to expect.

Start by asking yourself the following questions to determine if CFDs are right for your needs:

- What are CFDs and what is CFD trading?

- What are your financial goals?

- How high is your risk tolerance?

- Do you usually like to take risks in life?

- What is your investment time frame?

- Do you have time to monitor the markets?

- Are you looking for ways to increase your trading exposure?

- Are you mostly looking for short-term opportunities?

- Does your strategy involve taking advantage of bearish (downward) movements?

- Are you able to cope with stress?

- Are you looking for ways to hedge your existing portfolio?

Once you think you understand what you’re doing and what you’re doing it with, it’s time to start delving deeper…