Asia – Chinese trade optimism & a cash inject

Despite re- kindled Sino-US trade talks, Chinese indices this morning are in the red, the Shenzhen to the tune of -1.51%. The Hang Seng is up 0.13%, the Nikkei 0.02% and New Zealand’s DJ 0.33% after Statistics New Zealand showed a contraction in July’s Trade DeficitA trade balance that is negative as a result of cost (imports, on the national level) being greater ... to $0.12 bn YoY.

The Yuan jumped 3 pips against the dollar after the country’s central bank injected $29bn into the system through 14-day reverse repos.

The Yen overnight completed a double bottom after the nation’s leading economic index lost half a pointThe unit of price change for bonds (1%), futures (0.01%), shares ($1) and mortgage fees (1% of the p..., landing at 84.4 in June, while the coincident index added 2/10 to 76.6.

Europe – UK workers getting fired

Most European benchmarks wound up the day in the red, Tuesday, the FTSE losing 1.11%. Odd men out – the CAC40 with a 0.01% increase and Belgium’s BEL20 0.02%.

Based on IFO data yesterday, German current assessment at a pleasing 87.9 is better than their outlook for the future, which failed to hit the mark at 97.5. And yesterday’s CBI retail survey revealed job cuts at a decade-long record rate.

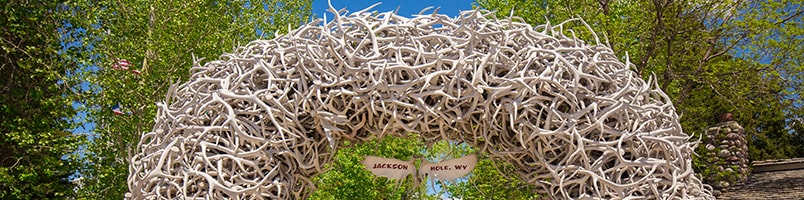

Americas – all await Powell in the Hole

Following its Apple-split adjustments, the Dow yesterday ended down 0.21%, the S&P up 0.36% and the Nasdaq 0.76%.

The USD is in a triangular pattern converging on 93.15 ahead of FED Head Powell’s speech to the Jackson Hole Summit, which opens overnight. Reuters quoted sources are expecting a dovish commitment as the pre-election economy sinks further into the hole.

A discrepancy occurred in the housing marketA location or entity where people and entities can negotiate and trade assets of value., the Federal Housing Finance Agency showing a better-than-expected 0.9% improvement in prices while the S&P Case Shiller index shows a disappointing 3.5% increase. New home sales also exceeded expectations with a 13.9% increase. And Consumer Confidence in August fell to a 6-year low at 84.8.

Commodities – Hurricane threat closes down Mexican rigs

The WTI/Brent spreadThe variance between the quoted buy and sell price of an asset. In forex it represents the moneychan... has widened further, the former losing 0.12% and the latter gaining 0.26% as US drillers closed 84% of offshore production in Mexico in anticipation of Hurricane Laura. Last night, the API reported yet another 4.5 mB drawdown.

Corporate – Nasdaq files for direct listing

ANT Group, Alibaba’s (+3.57%) payments and fintech division, has filed for a dual listing in Hong Kong and Shanghai in what Reuters believes could become the world’s largest IPO, so far, dwarfing Aramco at an estimated $200 bn.

American Airlines (-2.23% said it was cutting 19,000 jobs, beginning October 1st. Salesforce (+3.64%) yesterday reported a 29% increase in revenues to $5.15 bn. BestBuy (-0.43%) defeated expectations with a YoY revenues increase to $9.91 bn, and Urban Outfitters (+2.39%) lost 16% in sales YY bringing the total to $672 mn.

Meanwhile, Reuters reports that Nasdaq inc., the company that operates both the Nasdaq exchange and the index, has filed with regulators to enable companies to raise money through a direct listing – i.e. without the services of an underwriterA company - usually an investment bank, investment fund or consortium of such - that buys or guarant... – and prior to their initial public offering. Venture capitalists have been complaining that underwriters tend to underprice a listing in order to afford greater post-IPO profits to their clients. Today, expect earnings from Vienna Insurance, Eaton Vance and Netapp.

Events

| 09:00 AM GMT | Switzerland | ZEW expectations. GDP at 5:45 AM GMTGreenwich Mean Time (usually equals UTC – Universal Coordinated Time). GMT is a time zone, while U... (+1) |

| 11:00 AM GMT | US | Mortgage Applications. Durable Goods at 12:30. Jackson Hole Summit opens (ND) |

| 11:50 PM GMT | Japan | Foreign Investments. All industry activity at 4:30 AM (+1) |

| 02:30 PM GMT | OIL | EIA Crude Oil Stock Change |

Analysis

Want to read the rest of the aricle?